Is The Time To Go After Reverse Mortgage Leads Now?

I’m sure you’ve noticed the trend. Reverse mortgages are more popular than they were a few years ago. They certainly aren’t the most popular of mortgage leads, but reverse mortgage leads are growing steadily, and here’s why.

The economic downturn of 2008-09 has left many seniors struggling to adjust to living on a fixed income as the wealth of Americans continues to shrink.

One of the biggest reasons for the sudden increase of reverse mortgages is the fact that the baby boomer generation continues to grow. The US Census bureau indicates that there are over 39.6 million people over the age of 65 today. That number is expected to be around 80 million come 2050.

Currently the number of seniors represents 13% of the total population.

One of the key pieces of data to consider is that the financial holdings of this age group rests at a staggering $3.3 trillion dollars. Many of these holdings are either 100% owned or winding down on a primary mortgage.

Here’s How You Should Test The Waters When Pursuing Reverse Mortgage Leads.

If you’re hungry for additional mortgage leads, reverse mortgage leads can definitely be a healthy addition to your lead stream.

The question is, how do you generate more of these leads?

Obviously the bulk of your mortgage lead generation will not be coming from reverse mortgages. However, there is a healthy increase in the amount of applications for reverse mortgages.

Since housing values have stabilized, the fact that lenders exist to provide reverse mortgage leads means that cash strapped seniors are very interested in getting loans for them.

Fact is, many seniors are living on SSI and have a limited amount of financial mobility.

Which means for them, that reverse mortgages are a perfect opportunity to find their pocketbooks flush with cash without risking losing their benefit packages they currently receive.

Because this is true, it provides you a wealth of opportunity to offer reverse mortgages to cash strapped seniors while at the same time increasing revenue from these reverse mortgage leads.

One of the best ways to move into this market is to set up Internet marketing campaigns that will bring seniors hungry income flexibility into your sales funnel.

This can be accomplished in quite a few ways.

You can use:

- PPC advertising – PPC, or pay per click advertising is a wonderful method to use so you can offer laser precise ads for individuals looking for information on reverse mortgages. Even better with PPC advertising you can use A/B split testing to see which ad is working best to bring you more clicks, and run those in certain markets. PPC advertising has a proven history of being able to generate great leads. It’s important that you test your ads so you can measure the cost effectiveness of your campaigns. Here is a case study where we improved a companies’ lead generation by 700% simply by properly implementing PPC advertising protocols. Also with PPC advertising be sure to do your due diligence and avoid putting all your eggs in one basket with the keywords that you test.

- Analytics – Spread out the keywords your PPC campaigns target so you can get a thoroughly objective impression of how people are searching for reverse mortgages. Give yourself a hand up and use analytics tools like Google analytics to identify what people are searching for, and then begin to blog using those keywords to capture that traffic organically so you can avoid paying for clicks.

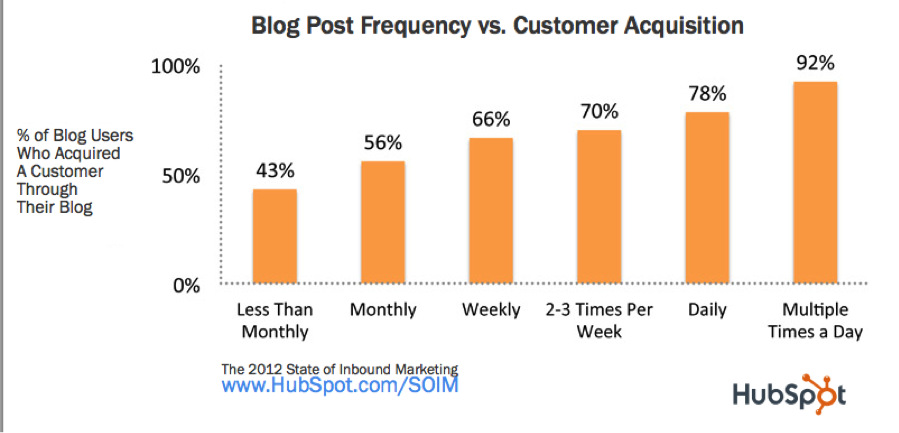

- Begin blogging – Blogging is one of the most effective ways for you to bring in new business. Businesses that blog regularly show an increase in the number of leads they acquire. As those interested in reverse mortgages often have questions, positioning yourself as an authority on reverse mortgages allows you to be their “go-to” for answers. Since they’ll be bringing questions to Google’s search bar, you blog is a great way for you to use your expertise as a way to answer their questions and encourage them to do business with you.

One of the important features of blogging is it’s a methodology of generating traffic for FREE. Using Google’s adwords tool you can establish what the popular search phrases are concerning reverse mortgages. Then you can incorporate these phrases into the content of your blog, including in titles, headlines, meta tags and the like to run a content marketing campaign that draws in organic traffic. See this article I wrote on content marketing for an efficient breakdown on using content marketing to drive in organic traffic. Blogging and content marketing are wonderful and robust ways to provide valuable information to individuals interested in reverse mortgages and a great way to guide them into your sales funnel.

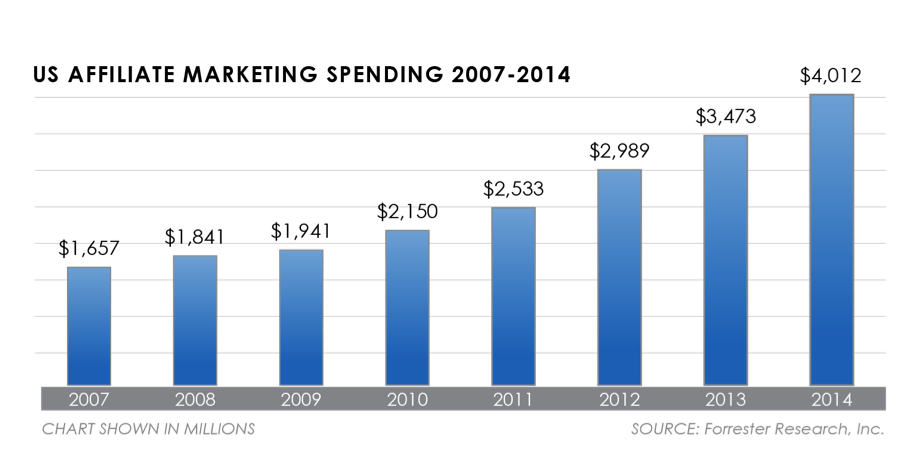

One of the important features of blogging is it’s a methodology of generating traffic for FREE. Using Google’s adwords tool you can establish what the popular search phrases are concerning reverse mortgages. Then you can incorporate these phrases into the content of your blog, including in titles, headlines, meta tags and the like to run a content marketing campaign that draws in organic traffic. See this article I wrote on content marketing for an efficient breakdown on using content marketing to drive in organic traffic. Blogging and content marketing are wonderful and robust ways to provide valuable information to individuals interested in reverse mortgages and a great way to guide them into your sales funnel. - Affiliate marketing –Affiliate marketing is another strategy to helping increase the number of leads you generate. As I’m sure you already know affiliate marketing relies on affiliates to help drive business your way. Not only is this method proven to lend to great profitability, it’s literally how commerce will operate in the future. To illustrate here’s a graph that shows that affiliate marketing is a great way to move into these types of mortgages.

As you can see the increase in spending through affiliates is growing quite steadily. Since reverse mortgages aren’t the most popular mortgage product you offer it’s of great value to you to have an affiliate network that pushes you leads you can work to close.

As you can see the increase in spending through affiliates is growing quite steadily. Since reverse mortgages aren’t the most popular mortgage product you offer it’s of great value to you to have an affiliate network that pushes you leads you can work to close.

Here’s Why Reverse Mortgages Are Great For You.

Reverse Mortgages are:

- Not taxable – This is great for seniors with Social Security or Medicare benefits.

- Subject to higher lending fees – Meaning you can collect more for producing reverse mortgages.

- Up sellable – Which means you can find additional opportunities for revenue on services and products you offer.

When pursuing reverse mortgage leads here are some key facts to consider.

Many seniors own their home, and have still seen their net worth diminished in recent years. Because of that, many are pursing opportunities to have more cash in hand as the cost of living rises.

Since reverse mortgages are a flexible loan type, there are many opportunities for you to meet the needs of these individuals.

Why You Need To Start Doing Reverse Mortgages Now.

In a recent press release HUD announced that changes will be coming to the reverse mortgage program.

HUD reports that they would…

“like to make “refined” changes that would limit the amount borrowers can withdraw upfront, and implement a financial assessment, and possibly establish some type of escrow account.”

The hope is such adjustments would limit the number of defaults caused by failure to pay taxes and insurance, which stand at an estimated 9%, according to a study from the Consumer Financial Protection Bureau this year.”

This is actually good news for you!

By adjusting the reverse mortgage program it allows for both you and your client to be protected from sketchy brokers who have been gaming the system.

Another benefit?

More trust will be placed in the reverse mortgage program. Currently there is a healthy amount of distrust amongst seniors in regards to reverse mortgages.

As the program gains strength and credibility you can capitalize on the change in regulations.

But it’s important to be one of early responders since changes to the program will bring many savvy brokers to the scene… keen to use them as a means to increase mortgage lead generation and profit.

By implementing online mortgage marketing programs you can experience a healthy growth in mortgage leads.

Optimizing your marketing efforts for reverse mortgage leads will prepare you for the increased traffic you experience as a result of more and more baby boomers looking to increase cash flow.

As an aside: I would like to add that in light of recent abuses of reverse mortgages that I don’t feel that reverse mortgages are appropriate in every situation. The tendency for abuses to occur when offering reverse mortgages is disheartening and tragic, and I don’t believe that all seniors who want a reverse mortgage should be offered one.

Please understand that I believe reverse mortgages are best dealt with on a case-by case basis.

Reverse mortgages might be a “necessary evil,” but that doesn’t mean they can’t be offered to those who are in a position to benefit from them.

Are you considering pursuing more reverse mortgages in the future?

What are your biggest concerns?

We’d love to hear what you think. Tell us what you think about this article in the comments below.

Latest posts by Wade Schlosser (see all)

-

shy